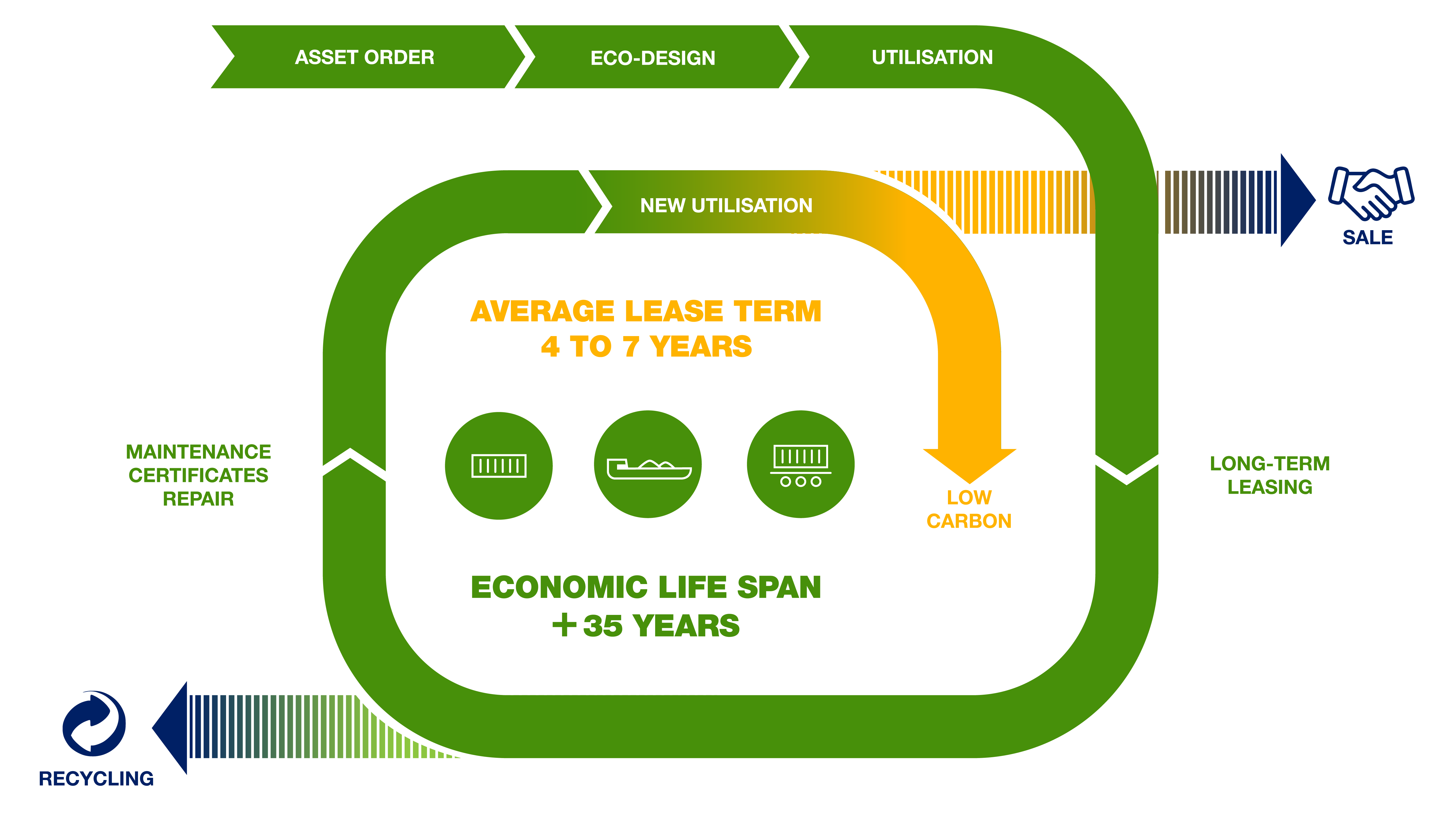

Touax's unique eco-responsible positioning can be appreciated by analysing its value chain. Through the life cycle of its assets, which begins at the order stage, Touax is a key player in low-carbon transport.

Eco-design

Our assets meet the growing market demands for environmental and safety standards. Technological innovations are also being introduced to optimize life cycles and improve the traceability of equipment.

Maintenance / Certificates / Repair

- The wagons follow specific maintenance cycles (at 3, 6 and 12 years)

- The barges are subject to navigation certificates that need to be renewed

- The containers are inspected every 30 months and receive ACEP certification

Recycling

Our equipment is almost entirely recyclable as it is primarily made of steel.

- Wagons are scrapped

- Barges are cleaned and dismantled

- On average, 8 out of 10 containers are reused (transformed for land-based uses, dismantled for spare parts), with the remainder being scrapped

Low Carbon

Our solutions allow our various clients to transport goods in a more sustainable manner compared to road, with multiple leasing cycles

Touax strives to reduce its climate footprint.

Since 2022, we have been tracking the carbon balance of our CO2 emissions according to scopes 1, 2, and 3. Our goal is clear: Strengthen the environmental policy, reduce scopes 1 and 2 emissions by 50% by 2025 and 100% by 2038, address scope 3 emissions through sustainable procurement, study and publish the full emission cycle of assets and improve the traceability of end-of-life asset recycling.

Touax is committed to sustainable finance.

Financing plays a true catalytic role, enabling long-term investments in low-carbon transport assets. For instance, since 2023, the Group has established a Green Finance Framework, aligned with the European taxonomy. This framework allows the issuance of green finance instruments to finance or refinance eligible assets and projects.

As of December 31, 2024, 75% of the Group's debt is "green" or linked to CSR performance criteria.

Since the beginning of 2024, Touax has also integrated ESG criteria into its investment decision-making process.